The EPFO Login Portal offers organized access to Provident Fund services for both individual members and registered employers. Through secure UAN login, users can view account details, check contribution history, download passbook statements, and submit online claims. Employers can also use a separate interface on the Unified Portal to manage compliance and contribution services.

The EPFO login system provides centralized digital access to Provident Fund services while ensuring secure authentication. It allows both members and employers to manage their accounts online without visiting EPFO offices. The portal helps reduce paperwork, speeds up service processing, and maintains transparent records.

This page explains how the EPFO Login process works, the connection between PF login and UAN login, how members can check and download their EPFO passbook, and how the Unified Portal brings various digital services together on one platform. The aim is to present clear and structured information aligned with official service standards.

What is EPFO Portal?

The Employees’ Provident Fund Organisation (EPFO) is a statutory body that manages Provident Fund schemes for salaried employees in India. It oversees contribution-based savings systems that provide retirement funds, pension benefits, and insurance support for eligible members.

Under the Provident Fund system, both employees and employers contribute a fixed percentage of the employee’s monthly salary. These contributions are deposited into the member’s PF account and earn interest over time. The accumulated balance helps support financial security after retirement or can be used during eligible withdrawal situations such as job changes or specific personal needs.

The organisation manages three main schemes:

• Employees’ Provident Fund (EPF)

• Employees’ Pension Scheme (EPS)

• Employees’ Deposit Linked Insurance (EDLI)

With digital advancements, members can now access these services through the EPFO login portal, reducing paperwork and improving the efficiency of service delivery.

EPFO Login – Access for Members and Employers

The EPFO login system serves as the main gateway to Provident Fund services, offering secure access for both individual members and registered establishments. It operates on a role-based system, where members and employers login using separate credentials and dedicated interfaces.

The login system uses secure authentication methods such as encrypted sessions, password verification, captcha checks, and OTP validation to protect user information.

Through EPFO login, users can access:

• Contribution and financial records

• EPFO passbook statements

• Online claim submissions

• Profile and KYC updates

• PF transfer requests

• Compliance management for employers

This system helps ensure organized, transparent, and efficient digital service delivery.

| NOTE – To avoid phishing risks, users should access EPFO Login services only through the official Unified Member Portal: unifiedportal-mem.epfindia.gov.in |

EPFO Member Login – Access Your Individual Account

EPFO Member Login is designed for employees registered under the Provident Fund scheme. Members can access the portal using their Universal Account Number (UAN Login) and password.

After logging in, members can:

• Check their total PF balance

• View and download the member passbook

• Submit online claim requests

• Track claim status

• Update KYC details

• Verify employer contributions

• Manage profile information

• Review employment history

The member dashboard provides a quick overview of account activity, pension details, and recent service requests.

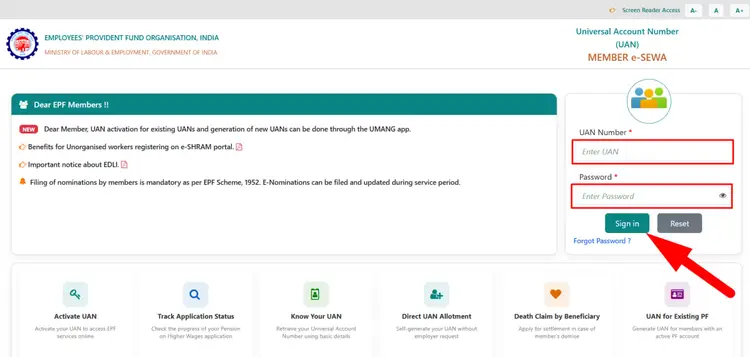

How to Log in to the EPFO Member Portal?

- Visit the official EPFO Member Login portal: unifiedportal-mem.epfindia.gov.in/memberinterface/

- Enter your UAN and password,

- then complete the captcha verification and click Login.

- After successful authentication, you will be redirected to the EPFO member dashboard.

If you are unable to Epfo login, ensure that your UAN is activated and your registered mobile number is linked for OTP verification.

EPFO Employer Login – Access for Establishments

EPFO employer login is designed for registered establishments that manage employee Provident Fund contributions. It allows authorized representatives to handle compliance-related activities according to EPFO regulations.

Through the EPFO employer portal, establishments can:

• Register new employees

• Upload Electronic Challan-cum-Return (ECR)

• Deposit monthly PF contributions

• Verify employee service records

• Generate compliance and audit reports

• Update establishment profile details

• Correct contribution-related discrepancies

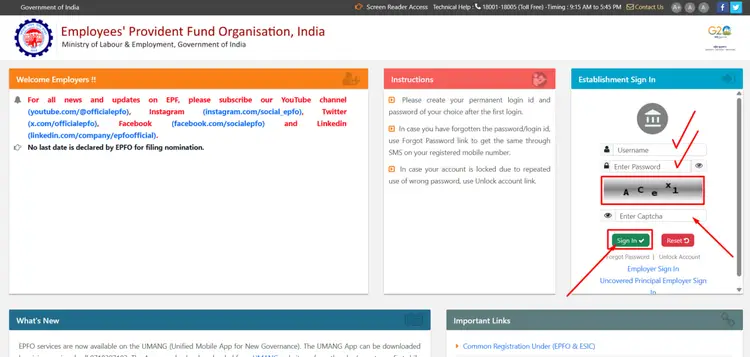

Steps to Complete EPFO Employer Login

- Visit the EPFO employer login page: unifiedportal-emp.epfindia.gov.in/epfo

- Enter your Establishment ID

- Enter the Password

- Complete the security verification

- Click Employer Login Button.

Employer login credentials are different from EPFO member login details and should only be used by authorized personnel. Submitting contributions on time ensures that employee EPFO passbook records show accurate monthly deposits.

EPFO Passbook Login – Check The PF Balance Online

The EPFO passbook service allows members to view detailed records of their PF contributions and earned interest. This digital facility improves transparency and helps members monitor their savings.

Through EPFO passbook login, users can check:

• Monthly employee contributions

• Employer contributions

• Pension allocation details

• Interest credited to the account

• Withdrawal transactions

• PF transfer records

Members can also download the EPFO passbook for record-keeping and financial planning purposes.

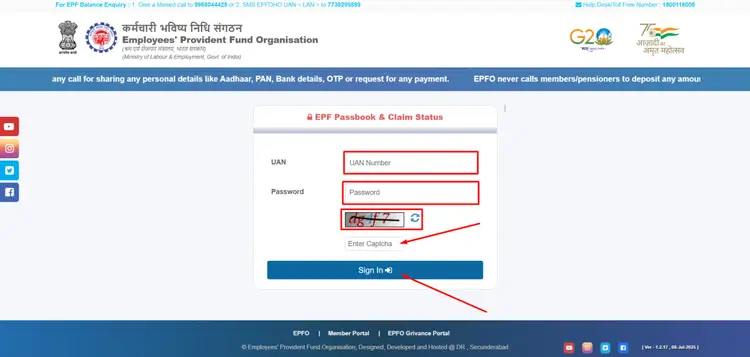

Process to Check EPFO Passbook Online

Complete EPFO member login at: passbook.epfindia.gov.in/MemberPassBook/Login.jsp

- After logging in, go to the Passbook section

- Choose your Member ID,

- View or download the passbook statement.

If the EPFO passbook is not visible, check that your UAN is activated and your KYC details are approved. Reviewing passbook entries regularly helps members confirm that employer contributions are deposited correctly.

EPFO UAN Login – Access Universal Account Number Services

The Universal Account Number (UAN) is a unique and permanent number assigned to each EPFO member. It links multiple employment records under one digital identity.

Through EPFO UAN login, members can:

• Access member portal services

• View and download the EPFO passbook

• Submit online claim requests

• Update KYC details

• Track PF transfer requests

• Manage employment-linked PF accounts

How to Activate EPFO UAN Login?

- Visit the Unified Member Portal

- Click on the UAN Activation Button

- Enter your UAN and required personal details

- Verify your mobile number using OTP,

- Create a login password.

After activation, members can use their UAN login to access all EPFO services online.

EPFO Unified Portal for Digital PF Services

The EPFO Unified Portal combines member and employer services into a single digital platform. It is designed to simplify access to PF services such as login, passbook viewing, online claim submission, and compliance management in an organized system.

The portal maintains separate access levels for members and employers while keeping all data within a centralized framework. Member login, employer login, and pension services operate within the same ecosystem but require role-based authentication.

Key services available on the EPFO Unified Portal include:

• EPFO Member Login

• EPFO Employer Login

• EPFO Passbook access

• Online claim submission

• UAN Activation and management

• KYC updates

• Grievance registration

• PF transfer requests

The EPFO dashboard provides a clear overview of account details, including contribution history, pending requests, and recent activities. This centralized system improves transparency and helps members manage their records more efficiently.

By digitizing services that were previously handled through manual paperwork, the Unified Portal helps reduce administrative delays and improves overall service efficiency.

EPFO Online Claim Portal for Withdrawal and Settlement

The EPFO online claim system enables members to submit withdrawal, settlement, or transfer requests online without visiting an EPFO office. This digital process improves efficiency and reduces the overall processing time.

Common EPFO online claim types include:

• Final settlement after leaving a job

• Partial withdrawal for eligible purposes

• Pension withdrawal benefits

• PF transfer between employers

Each claim type follows specific eligibility rules. Members should ensure that their KYC details are updated and bank information is verified before submitting a claim.

How to Submit an EPFO Online Claim?

Complete EPFO Member Login at: unifiedportal-mem.epfindia.gov.in/memberinterface

- Go to Online Services

- Select Claim Form

- Verify your personal and bank details

- Authenticate using OTP

- Submit the application.

After submission, members can track claim status through the EPFO dashboard, which provides updates on verification stages and approval progress. Online claim submission helps reduce errors and ensures a transparent and traceable process.

Understanding PF Balance & Contribution Tracking Details

PF balance is the total amount accumulated in a member’s Provident Fund account. It includes employee contributions, employer contributions, pension allocations, and the interest credited over time.

Members can check their PF balance through the EPFO Passbook Login after completing UAN authentication. The passbook displays monthly contributions along with interest updates.

Regularly checking PF balance helps members:

• Verify employer contributions

• Monitor long-term savings growth

• Identify any discrepancies

• Plan future withdrawals

If any inconsistency appears, members can contact their employer to verify ECR filings. Tracking contributions through the EPFO passbook ensures better financial transparency and accurate record-keeping.

EPFO PF Transfer Process with UAN Login Portal

When employees change jobs, transferring their PF balance from the previous employer to the current employer helps maintain continuous savings.

Using EPFO UAN login, members can start a PF transfer request online. The system merges balances under a single UAN-linked account, preventing multiple fragmented records.

Steps to Initiate PF Transfer:

Complete EPFO Member Login

Go to the Transfer Request section

Enter details of previous employment

Verify using OTP authentication

Submit the transfer request

Members can track the transfer status through the EPFO Unified Portal. Consolidating PF accounts makes passbook tracking easier and supports better long-term retirement planning.

EPFO Portal Security & Safe Access Tips

EPFO login security is maintained through encrypted sessions, password verification, and OTP authentication. Users should follow safe login practices to protect their accounts and personal information.

Recommended security practices include:

• Access EPFO services only through official portal websites

• Never share UAN login credentials with others

• Change passwords regularly

• Use strong and secure password combinations

• Avoid logging in on unsecured public networks

Phishing websites may imitate the EPFO login page, so users should always verify the website URL before entering their credentials.

The official Unified Member Portal address is: unifiedportal-mem.epfindia.gov.in . Following secure login practices helps prevent unauthorized access and protects account data.

Common EPFO Login Problems and Solutions

Users may sometimes face difficulties while accessing the EPFO login portal. Some common issues include:

Incorrect Password

Entering the wrong password multiple times may temporarily block access. Users can reset their password through the password recovery option on the login page.

Inactive UAN – If the UAN is not activated, EPFO member login will not work. Members must complete the UAN activation process before logging in for the first time

Unregistered Mobile Number – OTP verification requires a registered mobile number, so members should ensure their contact details are updated in EPFO records.

System Maintenance – At times, the EPFO portal may be temporarily unavailable due to scheduled system maintenance.

If login issues continue, users can contact EPFO through the official grievance or support channels for assistance.

EPFO Online Services and Member Facilities

For detailed guidance, you can explore the following services:

• Access your login dashboard for secure member services

• Check your passbook online to view the latest PF balance

• Activate your UAN before your first login

• Submit online claim requests through the portal

• Visit the Unified Portal for integrated EPFO services

These organized sections help improve navigation and make it easier for users to find relevant information.

Frequently Asked Questions – EPFO Login & Portal Services

| What is EPFO Login? EPFO login is the authentication system that allows members and employers to access Provident Fund services securely. |

| What is EPFO login? EPFO login is a secure authentication system that allows members and employers to access Provident Fund services online. |

| How can I access EPFO Member Login? Enter your UAN Number, password, and captcha on the login page to sign in to the EPFO Member Portal. |

| What is EPFO Employer Login used for? Employer login allows registered establishments to manage PF contributions, upload ECR files, and handle compliance-related tasks. |

| How can I check my EPFO passbook? Complete EPFO member login and go to the Passbook section to view or download your contribution records. |

| How do I activate UAN login? Visit the Unified Member Portal, enter your UAN and personal details, verify your mobile number with OTP, and create a password. |

| What is the EPFO Unified Portal? The EPFO Unified Portal is a centralized platform that provides access to member login, passbook services, online claims, and other PF-related facilities. |

| How can I submit an EPFO online claim? Log in using your UAN Number, go to Online Services, select the Claim Form, verify details with OTP, and submit the request online. |

| Is EPFO Login Secure? Yes, EPFO login uses encrypted sessions, captcha verification, and OTP authentication to protect user data. |